Fintech

Read the latest news and coverage of fintech, which stands for “financial technology,” focusing on everything from disruptor banks and innovations at established financial institutions to expense management startups, P2P payment services, checkout tools and the technologies that enable them.

Embedded finance is still trendy as accounting automation startup Ember partners with HSBC UK

Ember has partnered with HSBC in the U.K. so that the bank’s business customers can access Ember’s services from their online accounts.

Kudos lands $10M for an AI smart wallet that picks the best credit card for purchases

Kudos uses AI to figure out consumer spending habits so it can then provide more personalized financial advice, like maximizing rewards and utilizing credit effectively.

A US Trustee wants troubled fintech Synapse to be liquidated via Chapter 7 bankruptcy, cites ‘gross mismanagement’

The prospects for troubled banking-as-a-service startup Synapse have gone from bad to worse this week after a United States Trustee filed an emergency motion on Wednesday. The trustee is asking…

Bolt founder Ryan Breslow wants to settle an investor lawsuit by returning $37 million worth of shares

The investor lawsuit is related to Bolt securing a $30 million personal loan to Ryan Breslow, which was later defaulted on.

Cannabis industry and gaming payments startup Aeropay is now offering an alternative to Mastercard and Visa

The key to taking on legacy players in the financial technology industry may be to go where they have not gone before. That’s what Chicago-based Aeropay is doing. The provider…

Embedded accounting startup Layer secures $2.3M toward goal of replacing QuickBooks

So did investors laugh them out of the room when they explained how they wanted to replace Quickbooks? Kind of.

Lydia, the French payments app with 8 million users, launches mobile banking app Sumeria

Lydia is splitting itself into two apps — Lydia for P2P payments and Sumeria for those looking for a mobile-first bank account.

Indian insurance startup Go Digit raises $141M from anchor investors ahead of IPO

Go Digit, an Indian insurance startup, has raised $141 million from investors, including Goldman Sachs, ADIA, and Morgan Stanley, as part of its IPO.

Inside TabaPay’s drama-filled decision to abandon its plans to buy Synapse’s assets

Welcome to TechCrunch Fintech! This week, we look at the drama around TabaPay deciding to not buy Synapse’s assets, as well as stocks dropping for a couple of fintechs, Monzo raising…

Aplazo is using buy now, pay later as a stepping stone to financial ubiquity in Mexico

Four-year-old Mexican BNPL startup Aplazo facilitates fractionated payments to offline and online merchants even when the buyer doesn’t have a credit card.

Infighting among fintech players has caused TabaPay to ‘pull out’ from buying bankrupt Synapse

A dust-up between Evolve Bank & Trust, Mercury and Synapse has led TabaPay to abandon its acquisition plans of troubled banking-as-a-service startup Synapse.

Groww joins the first wave of Indian startups moving domiciles back home from US

Groww, an Indian investment app, has become one of the first startups from the country to shift its domicile back home.

India likely to delay UPI market caps in win for PhonePe-Google Pay duopoly

India’s mobile payments regulator is likely to extend the deadline for imposing market share caps on the popular UPI (unified payments interface) payments rail by one to two years, sources…

UK challenger bank Monzo nabs another $190M as US expansion beckons

Monzo has raised another £150 million ($190 million), as the challenger bank looks to expand its presence internationally — particularly in the U.S. The new round comes just two months…

Israeli startup Panax raises a $10M Series A for its AI-driven cash flow management platform

High interest rates and financial pressures make it more important than ever for finance teams to have a better handle on their cash flow, and several startups are hoping to…

Inside Mercury’s competitive push into software and Ramp’s potential M&A targets

Welcome to TechCrunch Fintech! This week, we’re looking at Mercury’s latest expansions, wallet-as-a-service startup Ansa’s raise and more! To get a roundup of TechCrunch’s biggest and most important fintech stories…

Startup neobank Mercury is taking on Brex and Ramp with new bill pay, spend management software

Digital banking startup Mercury is layering software onto its bank accounts, giving its business customers the ability to pay bills, invoice customers and reimburse employees, the company has told TechCrunch…

Honeycomb Insurance grabs $36M Series B from solo VC-led Zeev Ventures

When Itai Ben-Zaken’s first startup failed in 2018, the former BCG consultant and Wharton MBA spent months trying to understand what he could have done differently during the five years…

Accel leads $4M investment in Egyptian corporate cards platform Swypex

Cards are gaining ground in Egypt, with over 30 million in circulation (prepaid cards, particularly, are seeing more use than debit and credit cards combined). This surge in card usage,…

‘Wallet-as-a-service’ startup Ansa raises $14 million with female investors leading the way

Ansa, a startup that helps merchants develop and offer branded virtual wallets, has raised a $14 million Series A round of funding, the company has told TechCrunch exclusively. Renegade Partners…

Solo GP fund Andrena Ventures hopes to carry startup talent onto its next challenges

Gideon Valkin’s solo VC firm Andrena Ventures is raising $12 million from backers, including several VCs and entrepreneurs, and made its first investment into AI startup Nustom.

Backflip raises $15 million to help real estate investors flip houses

Flipping houses is not for the faint of heart, no matter how fun or easy HGTV might make it seem. One startup wants to make the process less complicated by…

Stripe’s big changes, Brazil’s newest fintech unicorn and the tale of a startup shutdown

Welcome to TechCrunch Fintech! This week, we’re looking at Stripe’s big product announcements, a bump in valuation for a Brazilian fintech startup and much more! To get a roundup of TechCrunch’s…

After 6-year hiatus, Stripe to start taking crypto payments, starting with USDC stablecoin

The company announced that it would start to let customers accept cryptocurrency payments, starting with USDC stablecoins, initially only on Solana, Ethereum and Polygon

Chilean instant payments API startup Fintoc raises $7 million to turn Mexico into its main market

Fintoc’s API lets online businesses accept instant payments coming directly from the customer’s bank account. This method, known as A2A, offers an alternative to credit card transactions.

Paystand acquires Teampay to be DeFi version of ‘Venmo for B2B payments’

“Teampay represents this new class of fintech companies that came up,” said Paystand CEO Jeremy Almond.

Stripe, doubling down on embedded finance, de-couples payments from the rest of its stack

Stripe continues to hold the title of being the biggest financial technology business still in private hands, with a current valuation of about $65 billion and a whopping $1 trillion in…

Fintech gaming startup Sanlo’s webshop tool could help developers avoid costly app store fees

Sanlo, a fintech startup that helps gaming companies manage finances, announced Wednesday the closed beta launch of its webshop tool, giving select game developers and studios a plug-and-play solution that…

RBI bars Kotak Bank from adding new online customers and credit cards

India’s central bank on Wednesday ordered Kotak Mahindra Bank to immediately cease onboarding new customers via its online and mobile banking channels and to stop issuing fresh credit cards, citing…

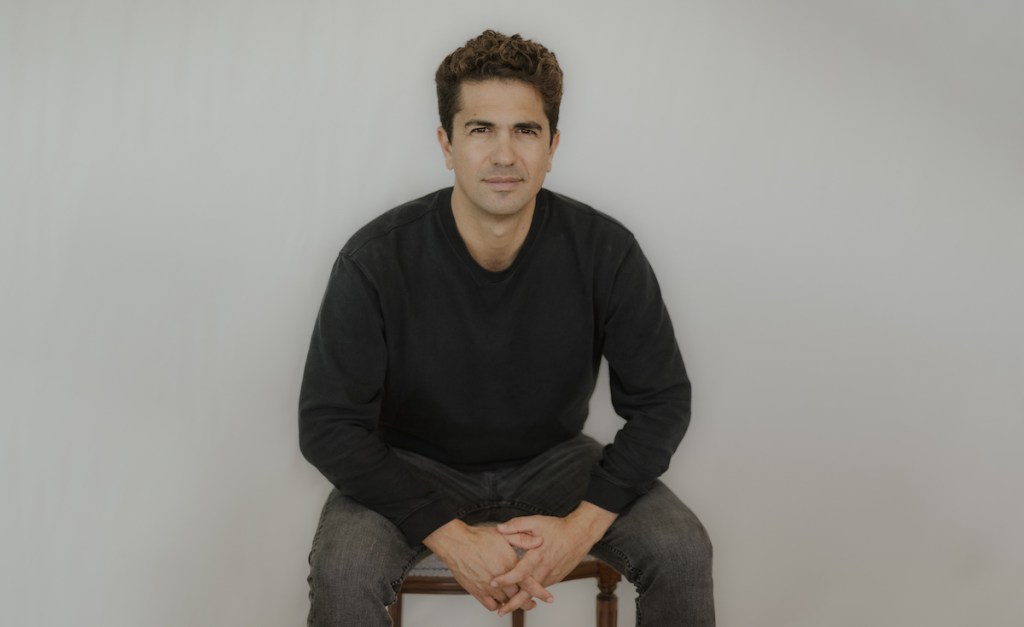

Featured Article

Fintech Fundid was shut down over interest rates and a strained cap table

To keep going, Fundid “needed to put up a lot more collateral because of the changing environment,” Stefanie Sample said.